Checking Out New York Residential Property Investment Opportunities: A Overview for Savvy Investors

New York is a prime location for residential property investors, using varied investment possibilities throughout its metropolitan centers, suburban areas, and breathtaking rural areas. The state's dynamic realty market brings in a range of financiers, from those thinking about high-yield rental residential or commercial properties to those concentrating on long-term asset growth through industrial or household growths. Understanding New York's investment landscape, essential regions, and residential property kinds will certainly furnish financiers with the understandings required to browse this affordable and lucrative market.

Why Invest in New York Real Estate?

New York provides a number of compelling reasons for home investment:

High Demand: With NYC as a global business hub, rental demand remains durable. The state's household and business buildings satisfy a series of requirements-- from households and trainees to professionals and companies.

Diverse Market: Investors can find lucrative opportunities in a selection of markets, including commercial, property, commercial, and retail.

Growing Population Centers: Upstate New York's population centers and New York City's five boroughs reel in people with profession chances, lifestyle, and amenities, adding to residential property recognition and rental demand.

Potential Tax Incentives: Particular zones in New york city deal tax benefits, which can be advantageous for lasting home investments and advancements.

Leading New York Property Investment Markets

1. New York City City (NYC).

NYC is a significant attraction genuine estate investors, with communities throughout the five districts providing differing levels of financial investment possibility.

Residential Rental Qualities: NYC's high population density and continuous increase of new homeowners make it a prime area for rental investments. Locations like Brooklyn and Queens, particularly, see high demand for rentals, making them eye-catching for multifamily investments.

Industrial Property: Office and retail area stay solid properties in Manhattan, specifically in industrial areas like Midtown and Wall Street. Post-pandemic, there's likewise require for flexible workplace.

High-end Dopes: Neighborhoods like the Upper East Side and Tribeca remain to attract high-net-worth individuals, making high-end homes and condos a rewarding financial investment.

2. Long Island.

Close to New York City, Long Island provides suburban living with distance to the city, making it a favored for households and experts seeking a quieter environment.

Single-Family Houses: Long Island's Nassau and Suffolk areas are preferred for single-family homes, specifically in suburban areas. These areas appeal to families searching for high quality institution areas and secure areas.

Seasonal Rentals: The Hamptons and Fire Island are locations for vacation rentals, especially in the summer. Seasonal rental residential or commercial properties in these locations supply superb rois.

Multifamily Real estate: With minimal real estate schedule in New York City, Long Island's multifamily devices supply an inexpensive alternative for those commuting to the city, making these properties a profitable financial investment selection.

3. Hudson Valley and Upstate New York City.

For financiers thinking about even more budget friendly property with possibility for recognition, Hudson Valley and Upstate New York offer various possibilities.

Rental Features: The Hudson Valley's closeness to NYC makes it a popular selection for travelers and remote workers. Cities like Beacon, New Paltz, and Kingston have actually seen boosted demand for rentals and 2nd homes.

Tourism and Vacation Properties: With breathtaking landscapes and outside recreational tasks, areas around the Adirondacks, Finger Lakes, and Catskills attract visitors year-round, making short-term rentals lucrative.

Pupil Real Estate: Albany, Syracuse, and Rochester are home to major colleges. Capitalists in these cities can profit from the constant need for student real estate by purchasing multifamily or small apartment buildings.

4. Albany.

New York's funding offers a steady property market with opportunities in property and commercial industries. Its steady economic climate, bolstered by federal government jobs and technology startups, makes Albany an appealing location for rental building investments.

Multifamily Investments: Albany's multifamily devices, especially around government offices and colleges, remain in demand by trainees, professionals, and households.

Business Space: Albany's economic climate is evolving, with growth in the modern technology sector producing need for office space and coworking atmospheres.

Single-Family New York property investment opportunities Houses: Albany's areas offer cost and a slower rate than NYC, drawing in households and retirees trying to find economical housing.

Techniques for Effective Property Investment in New York.

For investors aiming to take advantage of New York's competitive market, right here are some actionable methods:.

1. Assess Market Trends by Area.

Each area of New york city has unique financial drivers and residential property demand. Extensively looking into the details city or area can disclose understandings right into lasting profitability. For instance, while NYC offers high rental yields, Upstate New York may provide better long-lasting gratitude opportunities.

2. Understand Local Regulations.

New York has numerous building laws, specifically pertaining to rental buildings. NEW YORK CITY, for example, has particular guidelines for short-term leasings, zoning, and renter civil liberties. Recognizing these policies helps financiers avoid penalties and lawful difficulties.

3. Focus on Rental Need.

Rental need is strong in urban and suburban areas alike, giving exceptional opportunities for regular earnings. By focusing on rental properties-- whether temporary, mid-term, https://sites.google.com/view/real-estate-develop-investment/ or long-lasting-- investors can maximize constant cash flow. In areas like the Hamptons and Hudson Valley, seasonal rentals can additionally provide substantial income.

4. Think About Residential Or Commercial Property Monitoring.

If investing in regions much from NYC, property administration is important for remote proprietors. Employing a trusted home management firm assists preserve rental buildings, manage tenants, and manage daily operations. This technique makes sure a favorable rental experience and lowers the investor's hands-on time dedication.

5. Take Advantage Of Financing Alternatives.

Securing funding is essential, especially in open markets like NYC. Capitalists can benefit from financing options such as mortgage, industrial financings, and collaborations, which can assist take full advantage of buying power and improve returns.

Future Patterns in New York Property Financial Investment.

As New york city's realty market develops, investors can anticipate new opportunities and obstacles:.

Remote Job Influence: The rise of remote job has improved real estate demand, specifically in country and Upstate areas, as people look for even more inexpensive choices outside New York City.

Sustainable Advancement: Green developments and eco-friendly buildings are obtaining appeal, specifically in metropolitan facilities. Properties with sustainable features might bring in eco aware occupants and customers.

Boosted Passion in Second Cities: Cities like Albany, Buffalo, and Rochester are attracting passion for their affordable residential properties and New York property investment opportunities boosting local economic climates, developing financial investment capacity beyond NYC.

New York's real estate market supplies varied home financial investment chances, from Manhattan's skyscrapers to Hudson Valley's moving landscapes. Financiers can maximize different residential or commercial property types and areas relying on their objectives, be it rental earnings, home recognition, or long-lasting wealth development. By recognizing regional market dynamics, staying informed on regional policies, and choosing the right residential property administration techniques, investors can attain rewarding outcomes in among the country's most interesting residential property markets.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Kelly McGillis Then & Now!

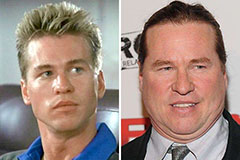

Kelly McGillis Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Shane West Then & Now!

Shane West Then & Now!